The financial services industry has undergone immense disruption in recent years, with fintech innovators and digital giants eroding the market share of traditional banking institutions. These new players are championing enhanced customer experiences through personalization as a common strategy to drive user adoption and build market share. In this cloud-centric narrative, we’ll explore the value of personalization in retail banking and how AWS services can be leveraged to empower this transformation with Incedo LighthouseTM.

The Value of Personalization for Retail Banking

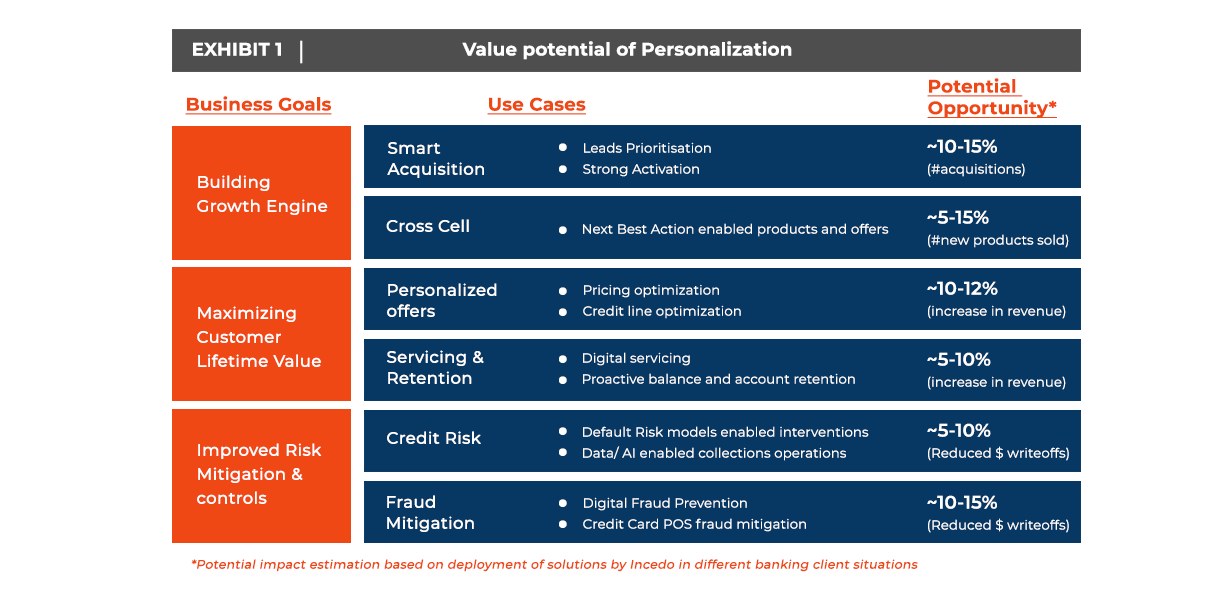

The adoption of personalization strategies has become a central focus for banks to enhance customer experience and deliver significant business impact. This includes:

- Building a Growth Engine for New Markets and Customer Segments

New-age fintech companies have leveraged data-driven products for expedited underwriting, utilizing data like bureau scores, digital KPIs, and social media insights to assess a prospect’s creditworthiness. Traditional banks must swiftly adopt similar data-driven approaches for faster loan fulfillment and to attract new customer segments. AWS cloud services can facilitate this transition at speed by offering scalable, flexible, and secure infrastructure.

- Maximizing Customer Lifetime Value

To maximize the share of customers’ wallets, banks are now focusing on improved cross-selling, superior servicing, and higher retention rates. Next-generation banks are employing AI-driven, next-best-action recommendations to determine which products to offer at the right time and through the most effective channels. This shift involves transitioning from reactive retention strategies to proactive, data-driven personalized approaches.

- Improved Risk Assessment and Mitigation Controls

Personalization is not confined to marketing; it extends to risk management, fraud detection, anti-money laundering, and other control processes. Utilizing sophisticated AI models for risk, fraud, and AML detection, combined with real-time implementation, is crucial to establishing robust risk defense mechanisms against fraudsters.The impact of personalization in retail banking is transformative, with opportunities to enhance experiences across all customer touchpoints. Incedo’s deployment of solutions for banking and fintech clients showcases several use cases and potential opportunities within the cloud-based landscape.

Building a Personalization Engagement Engine with AWS

A successful personalized engagement engine necessitates integrated capabilities across Data, AI/ML, and Digital Experiences, all hosted on the AWS cloud. The journey begins with establishing a robust data foundation and a strategy to enable a 360-degree view of the customer:

- Data Foundation to Support Decision Automation

Traditional banks often struggle to consolidate a holistic customer profile encompassing product preferences, lifestyle behavior, transactional patterns, purchase history, preferred channels, and digital engagement. This demands a comprehensive data strategy, which, given the extensive storage requirements, may require building modern digital platforms on AWS Cloud. AWS services and tools facilitate various stages of setting up this platform, including data ingestion, storage, and transformation.

AWS Glue: A large amount of frequently updated data in various source systems that are needed by the ML models is brought into the common analytical storage (data mart/data warehouse/data lake, etc.) using AWS Glue jobs, implementing ETL or ELT logic along with value-add processes such as data quality checks and remediation.

- AI, ML, and Analytics-Enabled Decisioning

Identifying the right product or service to offer customers at the ideal time and through the preferred channel is pivotal to delivering an optimal experience. This is achieved through AI and ML models built on historical data. AWS offers services like Amazon SageMaker to develop predictive models and gain deeper insights into customer behavior.

AWS Sagemaker: The brain of Personalization lies in the Machine Learning models that take advantage of the wealth of customer-level data across demographic, behavioral, and transactional dimensions to develop insights and recommendations to enhance the customer experience significantly, as explained in the use cases above.

- Optimal Digital Experience

Personalization goes beyond data; it requires the right creatives and effective communication to drive customer engagement. AWS services for data integration and analytics enable A/B testing of digital experiences, ensuring the creation of best-in-class customer journeys.While data, AI, and digital experiences are the core building blocks of a personalized engagement layer, the orchestration and integration of these capabilities are essential for banks to realize the full potential of personalization initiatives. Building these capabilities from scratch can be time-consuming, but the AWS Cloud provides the scalability and flexibility required for such endeavors.

AWS Compute: AWS provides scalable and flexible computing resources for running applications and workloads in the cloud. AWS Compute services allow companies to provision virtual servers, containers, and serverless functions based on the application’s requirements, enabling pay for what you use, and making it a cost-effective and scalable solution. Key compute services used in Incedo LighthouseTM are Amazon EC2 (Elastic Compute Cloud), AWS Lambda, Amazon ECS (Elastic Container Service), and Amazon EKS (Elastic Kubernetes Service).

Turning Personalization into Reality with Incedo LighthouseTM and AWS

Building personalization capabilities is just the first step; embedding personalization recommendations into enterprise workflows is equally critical. This integration ensures that personalized experiences are not just theoretical but are actively implemented and drive customer engagement.

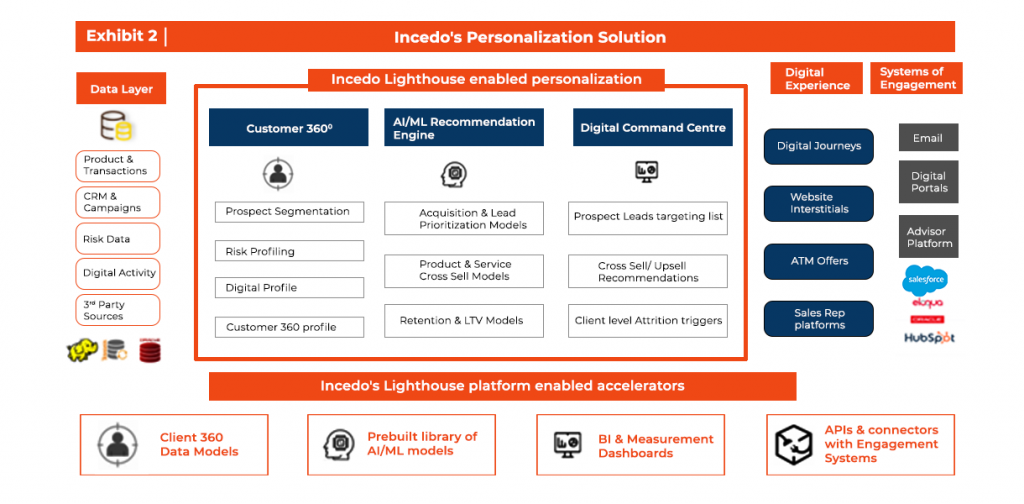

Incedo’s LighthouseTM solution for CX personalization accelerates the journey, offering an enterprise-grade solution that significantly reduces time-to-market for data/AI-enabled marketing personalization. It automates AI/ML-enabled decisions from data analysis to customer outreach, ensuring personalized offerings are delivered to customers at the right time. Incedo’s solution includes a prebuilt library of Customer 360-degree data lakes and AI/ML models for rapid implementation, supported by digital command centers to facilitate omnichannel engagement.

No matter where banking clients are in their personalization journey, Incedo’s solution ensures that they experience tangible benefits within weeks, not years. The implementation is complemented by a personalization roadmap that empowers organizations to build in-house personalization capabilities.

In the fast-paced world of banking, personalization is essential for acquiring new customers, maximizing their value, and retaining the best customers. Trust, combined with personalization capabilities, ensures traditional banks maintain their competitive edge against fintech players and digital giants.

In the ever-evolving landscape of financial services, personalization powered by AWS offers banks a strategic advantage in acquiring and retaining customers. Incedo’s LighthouseTM solution, hosted on AWS Cloud, enables rapid implementation and ensures that banks can quickly harness the benefits of personalization. This approach is not just a trend but a necessity for banks looking to stay competitive and provide a superior banking experience.