Digital Transformation was one of the most important business trends across the wealth management circles before the unprecedented global disruption shifted all the focus towards ensuring business continuity. Recognizing the changing digital behavior, leading RIA custodians, broker dealers, TAMPS, RIAs had either embarked or were kickstarting their digital transformation journeys. The disruption caused by COVID 19 has clearly laid bare the nascent stages of digital evolution for the many wealth management players. The customer service centers are overwhelmed with increased call volumes and reduced capacities. Similarly, financial advisors are required to field multiple long calls from anxious clients who are uncertain about their investments. Low adoption of digital assets provided by broker dealers and RIAs firms may be a result of sub optimal CX or gaps in information availability. We all may be in a long period of disruption, and the firms that are not able to drive digital adoption, or continuing to remain person dependent will realize the difficulty in client servicing, let alone operational scaling. Digitalization needs to be looked at as an essential part of the wealth manager’s business continuity efforts as it ensures information availability and provides online self-service capabilities. Digital Insulation is another complementary term that offers an ambitious glimpse of future possibilities. To protect their businesses from personnel-related disruptions, organizations will need to invest digitalization and thus ensure business continuity.

Drivers of Digital Transformation

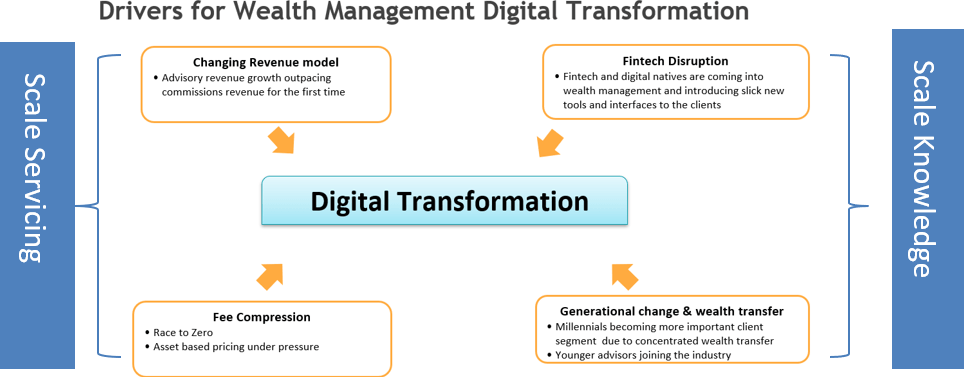

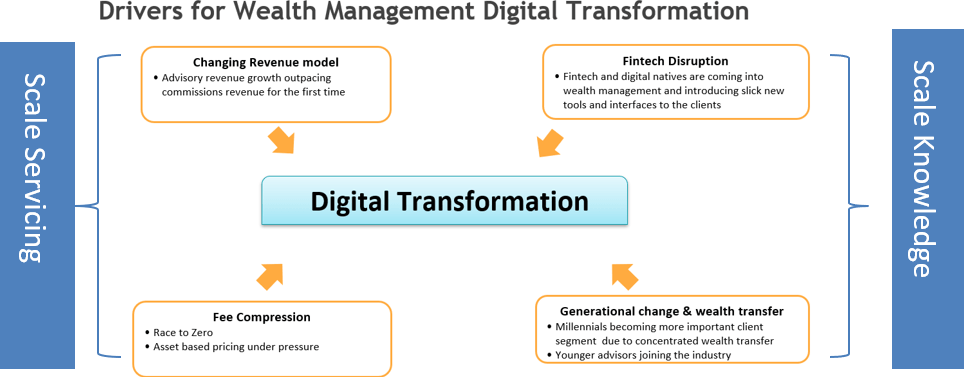

Digitalization in the wealth management was primarily driven by the following drivers:

- Changing business model– The business model has been steadily shifting away from a product focused brokerage model to a relationship focused advisory model. In a study conducted by https://www.financial-planning.com/ , the consolidated commissions revenues for the top 50 Independent broker dealers have reduced in the last 5 years, while the advisory fee has increased by more than 50% in the same period. Shifting client base of advisory clients expect engagement across multiple channels and customer experience becomes paramount.

- Revenue compression– Zero commissions are already a reality and were a seminal event for the industry. Revenue impact for the players will range from anywhere between 10%- 20%. Also, RIA custodians are likely to levy additional fees on the participants to cover for the lost revenues. With the fed rates likely to remain low for the foreseeable future, the revenue stream from sweep accounts will also reduce substantially further, thus accentuating revenue pressures.

- Changing the age mix of client and advisors– As the wealth transfers from baby boomers to the millennials, the millennials will make up for an increasingly valuable client segment. Similarly, as the ageing advisor population retires, the new advisors will primarily be dependant on technology, largely influencing their business decisions.

- Fin Tech Disruption– Advisor Fintech tools, also known as Advisor tech, have not only invaded the usual favorites domains such as CRM, financial planning, and portfolio management but have created new advisor tech segments such as mind mapping, account aggregation, forms management, social media archiving etc. 2020 T3 advisor software survey covered almost 500 different tools across almost 30 sub segments highlighting the plethora of tools available for clients and advisors.

The above drivers are creating two main needs for the wealth management players:

Need to Scale Servicing. The first two drivers (changing business model and revenue compression) are forcing wealth management players to realize the need to digitalize and gain operational scale for servicing more clients. In a study conducted by https://www.refinitiv.com/en, servicing clients was cited as the most important digital driver for the wealth management firms. The ongoing disruption will further fuel the demand for straight through client onboarding, E- account opening, digital signatures, and workflow-based proposal generation solutions. Moreover, the organizations that still depend on back office processors to open accounts and onboard clients will see an increased transition. Similarly, advisors and clients need to be provided with tools to move to a more self-service model.

Need to Scale Knowledge– The last two drivers (changing Age mix & FinTech Disruption) trends have resulted in increasing client and advisor expectations. An increasing number of clients no longer just delegate their investment decisions to advisors but also seek to collaborate and validate the investment decisions. They look for real time knowledge about their current investment and investment insights. With the prevailing uncertainty, many clients will also start demanding real time information about risk tolerance of their portfolios are and how they can quickly pivot to either protect their investments or to take advantage of any profitable bargains. The clients will naturally drift towards financial advisors who provide full-service client portals to access and monitor their investment. Similarly, advisors will drift towards firms which provide digital practice management tools and advisor self service capabilities.

The third form of scale which will become very relevant in the current disruption is Scaling digital collaboration. With Social distancing becoming the norm, in person client meetings may not be possible for some time. While advisors and clients can still talk and make video calls, current tools do not allow for collaborative discussion or presentations. Going forward, the organizations will need to invest in tools that enable online client engagement and advice delivery as a complimentary engagement channel. Software providers can study the evolution of telemedicine systems, which provide a full suite of features including video conferencing, document sharing, scheduling appointments, taking notes, as well as client history. Once client portals or CRM systems can be enhanced for Tele Advice, this alternate engagement channel is likely to grow in popularity with both clients and advisors, allowing remote collaboration and engagement.

To sum up, digitalization is the best antidote for any such future disruptions, which will be assisting wealth management firms in modernizing advice and accelerate their digitalization efforts to not only transform but to insulate their businesses. Digitalization can in fact become a vital cog of the business continuity efforts by enabling self-service, information disintermediation and collaboration.